Would you like to save your money and let it grow? But do you know how to open KCB Mpesa fixed deposit account in Kenya and earn interest?

It is an easy and safe way to save your money until the time you need it is used, and it will earn interest.

In this article, I will share how to open KCB Mpesa fixed deposit account.

Sometimes it is hard to save money on your wallet as you will get to use it but putting that money on a fixed deposit account safeguards your money.

You are confident your money is safe and growing, expecting assured returns.

Table of Contents

What Are Fixed Deposits?

A fixed deposit account is almost like savings accounts.

The distinction between the two is that with fixed deposits, you cannot withdraw the money anytime you would like after making the deposit.

The money will be due for withdrawal after the set time lapses.

Also, the more you set the money to be on the fixed account, the more interest it earns.

KCB Mpesa Fixed Deposit Account [2022 Update]

Either you deposit local and foreign currencies; your money will attract a good interest rate.

You have to allow the money to stay on the fixed account at the agreed time.

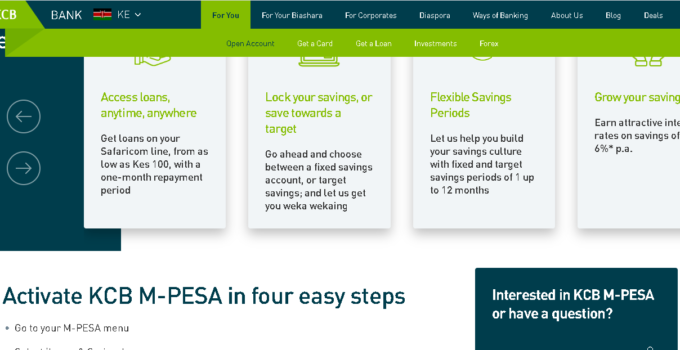

KCB Mpesa offers an interest rate of 6% per year on your deposit to the fixed deposit account.

The more money you save and the more time you set will mean more interest.

You have the chance to assess the returns you get from your investment with the KCB fixed deposit rate account.

Since the investment size is not limited, you can decide on the initial amount to save.

Additionally, there is no fixed investment period, so you can pick what works best for you from one and twelve months.

KCB is one of the banks with fixed deposit accounts with the most flexible interest rates in Kenya.

How To Open A KCB M-PESA Fixed Deposit Account

It is quick and simple to open a KCB M-PESA fixed deposit account as there is no paperwork involved.

The process is done on your mobile phone.

Here are the steps to follow to register for KCB Mpesa Fixed Deposit Account in Kenya:

1. Go to your phone apps and select sim Toolkit.

2. Select the M-PESA menu

3. Next, select “Loans and Savings”

4. Select KCB M-PESA

5. After that, select Fixed Savings Account

6. Select Fixed deposit

7. Open KCB Mpesa Fixed Deposit Account

8. Select the source of funds either from M-PESA or KCB M-PESA

9. Enter amount (minimum amount is KES 500)

10. Enter period between 1 and 12 months

11. Enter M-PESA pin

12. Confirm the transaction

Within a few minutes, you’ll receive a text detailing the account has been set and the initial amount.

You can go ahead and add more money to the account.

See also: How To Check And Link BVN Details To Fidelity Bank.

Does KCB Mpesa Earn Interest

Yes. With a KCB Mpesa savings account, you can save and earn interest of up to 6.3% per annum.

This means when you save with KCB Bank via Mpesa for some period, you can earn an interest of 6.3% every year.

That is how much and even more you can earn on saving with Safaricom M-Pesa.

Here is the list of our KCB articles:

Mobi Loan, Internet Banking, Careers, Cub Account, Forex Exchange, Types of Accounts, Activate Mobile Banking, Mpesa Loan, Savings Account, Tuungane Chama Account, Apply for Credit Cards, KCB Opening Hours, KCB Mpesa Interest Rate, Diaspora Banking, Salary Advance, Paybill Number, Savings Interest Rate, Business Account, Prepaid Master Card, KCB Student Account.

- How To Increase My UBA Mobile Banking Limit – UBA Transaction Limit

- Transfer Limit For UBA Bank In Nigeria – Know Your Transaction Limit

- How Do I Reset My UBA PIN In Nigeria – Change Your PIN

- UBA Nigeria Verve Debit Card – Ultimate Guide To UBA Verve Card

- UBA Visa Dual Currency Debit Card (DCDC) In Nigeria

- How To Check GCB Account Balance Online – Ghana Commercial Bank

- UBA Visa Classic Debit Card In Nigeria – Get A Classic Card Now

- UBA Gold Mastercard Debit Card For Domiciliary Account In Nigeria

- UBA Gold MasterCard Debit Card In Nigeria – UBA Debit Card Guide

- UBA Debit Mastercard In Nigeria – UBA MasterCard Guide

- How To Know If Your Nigerian UBA Account Is Still Active

- How To Get My UBA Bank User ID In Nigeria

Dollar Rate, Graduate Trainee Apply, Apply For Loan, Fidelity Email, Account Number, Fidelity BVN, Block Account, Download Statement Online, Mobile Money Transfer, Upgrade Bank Account, Get Fidelity Token, Borrow Money, Fidelity job Nigeria, Activate Mobile App, Get POS Machine, Apply For Fast Loan, Bank Transfer PIN, Transfer With Fidelity Bank Code.